Global Venture Outlook – a mid-year review

In the ever-evolving landscape of 2023, the world of entrepreneurship has undergone notable shifts and developments. As we navigate through the first three quarters of the year, it becomes evident that founders and investors have adhered to their fundamental principles while strategically evaluating their operations, fundraising approaches, and investment decisions in alignment with their risk preferences. This analysis offers an overview of the observed trends and dynamics in the venture capital sector during this period.

During the first half of 2023, we witnessed a moderation in the flow of capital across regions. Global investment volumes have experienced a noticeable decline, prompting market participants to adopt a more measured approach. Interestingly, there has been an increase in venture capital activity, marking the entry of private enterprises into the market, many of which are making a reentry since the previous downturn. Furthermore, the prominence of alternative funding sources, tailored to specific risk appetites, has been on the rise, indicating a strategic diversification in funding approaches.

Key Insights

- Transaction activity remains consistently above the levels recorded in 2020, underscoring the resilience of the entrepreneurial ecosystem.

- Endeavor Catalyst’s investment pace in emerging markets demonstrated a significant 40% quarter-on-quarter increase in Q2 2023. Remarkably, this surge in investment originated from regions such as Kenya, UAE, and Mexico.

- Anticipations for Q3 indicate the quarter’s potential to be the most active within the year, reflecting the current pipeline activity.

- Notably, public market indicators, such as the S&P 500 and Nasdaq, have displayed robust double-digit growth. This growth has acted as an encouraging factor for private sector players, shaping their investment sentiments.

- An uptick in venture capital activity as private companies made it into the market, many for the first time since the downswing.

- Embracing alternative funding sources tailored to each company’s risk appetite has also gained prominence.

- The level of transactions remains above the level last seen in 2020.

The dynamism of public markets has exerted a substantial influence on the private market landscape. Unforeseen gains witnessed in the S&P 500 and Nasdaq during H1 2023 have prompted private market participants to engage more thoughtfully, even while maintaining cautious optimism. This cautious approach is consistent with the deployment pace, which mirrors the trajectory of Nasdaq’s performance since 2019. Such strategic prudence is emblematic of investors’ and founders’ measured outlook toward market dynamics.

Over the next twelve months, a strong focus on capital efficiency is anticipated, with an emphasis on low burn rates and exceeding runaway. A notable trend is the potential for reduced fluctuations in market valuations, particularly in less favorable market environments. To counter potential down-rounds, founders are increasingly exploring alternative financing avenues. In this context, Endeavor Catalyst’s portfolio has witnessed an increase in insider-led rounds, extension rounds, and bridge financing. Founders are leveraging instruments such as SAFE notes, convertible notes, and venture debt to bolster their financial strategies.

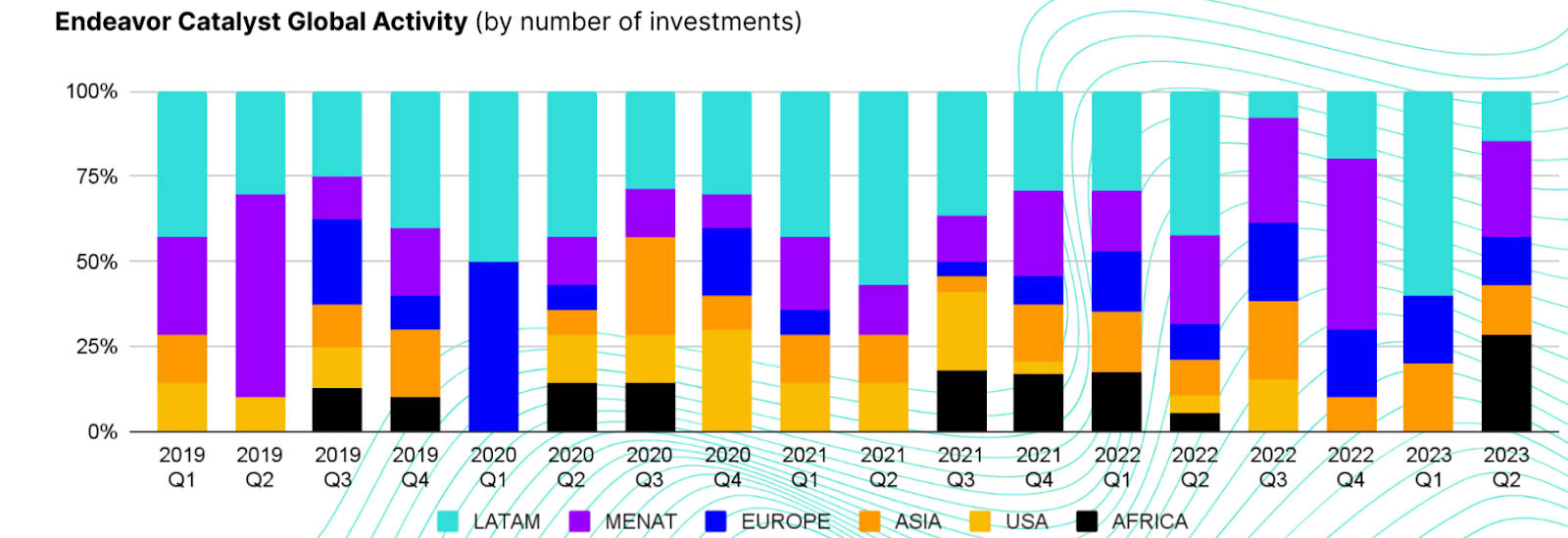

In a landscape where each market is akin to a distinct constellation, investors are adopting a targeted approach toward their existing portfolio companies. This approach has led to a controlled flow of capital, both in terms of geographic and sectoral considerations. The geographic classification has become more defined over time, reflecting the evolving global investment scenario. Latin America emerges as a pivotal market for Endeavor Catalyst, while Asia maintains its reputation for consistent investment activity. Africa, while sporadic in activity, has attracted increasing attention from venture capital.

Market specifics

- LATAM: The region faced the retreat of growth equity firms but has witnessed increased early-stage activity. Brazil and Mexico have demonstrated strong appeal in capturing capital flows.

- MENAT: With government support, the MENAT region’s venture capital ecosystem remains robust. Egypt stands out as the fastest-growing market for Catalyst Investments.

- Asia: This market showcases resilience, particularly in late-stage investments supported by growth investors. H1 2023 was a historic period for Asia’s participation in Endeavor Catalyst.

- Indonesia: This market is a standout due to its status as the fastest-growing global internet economy. Catalyst Investments have made significant inroads here.

- US: The Bay Area experienced reduced IPO activity, while mergers and acquisitions have picked up pace, especially in the Tech sector.

- Europe: Despite a significant decrease, the European VC ecosystem displays resilience. Italy emerges as a vibrant market, fueled by private equity and family office activities.

- Africa: The continent has witnessed increased venture capital attention, particularly in markets like Kenya and South Africa. Agtech is gaining traction, while South Africa remains a dominant force.

Read Endeavor Catalyst’s full report of the venture capital landscape. These insights underscore the importance of strategic prudence, capital efficiency, and diversification in investment approaches. As markets continue to evolve, it becomes evident that each market is characterized by its unique constellation of opportunities and challenges. Investors, founders, and market participants navigate this cosmos with an eye on sustainable growth and prudent decision-making.